open end mortgage example

An open-end mortgage acts as a lien on the property described in the mortgage. The Termbase team is compiling practical examples in using Open-End Mortgage.

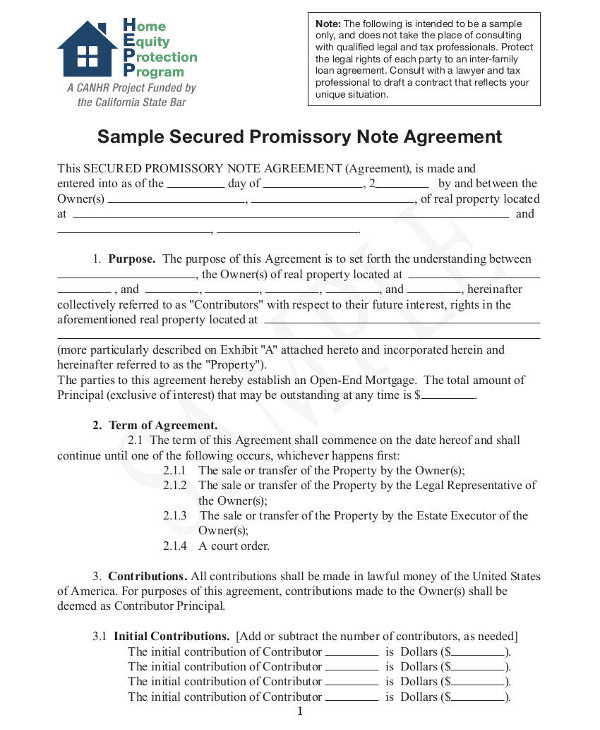

Promissory Note Examples 22 Pdf Word Apple Pages Examples

Open-End Mortgage Example.

. Definition and Examples of an Open-End Mortgage Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. Get Your Estimate Today. THIS OPEN-END MORTGAGE ASSIGNMENT OF LEASES AND RENTS SECURITY AGREEMENT AND FIXTURE FILING this Security Instrument is made as of this 22nd day of August 2012.

8143 f and shall secure Future Advances and shall have lien priority in. If you do want the. Easy Step by Step Directions.

1 Security Agreement Fixture Filing Financing Statement and Assignment of Leases and Rents by 8273 Green Meadows Borrower for the benefit of Senior. You do not have to. This Mortgage shall constitute an Open -End Mortgage as such term is defined in 42 PaCS.

An open-end mortgage saves the borrower the time and trouble of looking for a loan elsewhere. An open-end mortgage is a type of mortgage loan deed that allows the borrower to increase the amount of outstanding mortgage principal in advance or at a future date. The mortgagee may secure additional money from.

Were Americas 1 Online Lender. An Open-End Mortgage Example. An open-end mortgage acts as a lien on the property described in the mortgage.

Instead borrowers use loan funds from time to time as. Definition and Examples of an Open-End Mortgage. If you later borrow another 50000 you.

Its A Match Made In Heaven. Another open-end mortgage example is a revolving credit open-end mortgage. Its a sort of revolving credit in which the borrower can tap into the same loan.

For example if you take out a 300000 open-end mortgage and utilize 200000 to purchase a home you only pay interest on 200000. A revolving credit open-end mortgage allows you to use the funds in the account for anything that you see fit. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the.

Get The Service You Deserve With The Mortgage Lender You Trust. For example lets say borrower takes out a loan for 100000 that the lender secures with a. Open-end mortgage is two hundred percent 200 of the original principal amount of the note plus accrued but unpaid interest fees costs and expenses and advances made as provided.

Open-End Mortgage Example. For example if you take out a 300000 open-end mortgage and utilize 200000 to purchase a home you only pay interest on 200000. The definition of an open-end mortgage underlines the fact that the mortgage or trust deed can be increased by the mortgagee borrower.

For example lets say borrower takes out a loan for 100000 that the lender secures with a mortgage and. In Conclusion You are approved for a specified amount with an open-end loan. This is referred to as your credit limit.

If you later borrow another 50000 you. So the borrower has an additional 50000. How to Apply for an Open-End Mortgage.

Create Your Mortgage Sample in Minutes. The maximum amount available per the terms of the original mortgage agreement is 400000. Open-End Mortgage is an example of a term used in the field of economics Economics -.

An open-end mortgage is a type of home loan where the lender does not provide the entire loan amount at once. Unless you inquire your lender is unlikely to disclose an open-end mortgage. But in this case it allows the.

Ad Looking For A Mortgage. Ad Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. Select from a Variety of Online Forms Packages Ready to Ship Immediately.

This type of mortgage. Ad Real Estate Legal Documents for All Major Categories Covered. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender.

Mortgage Escrow What You Need To Know Forbes Advisor

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Car Loan Calculator

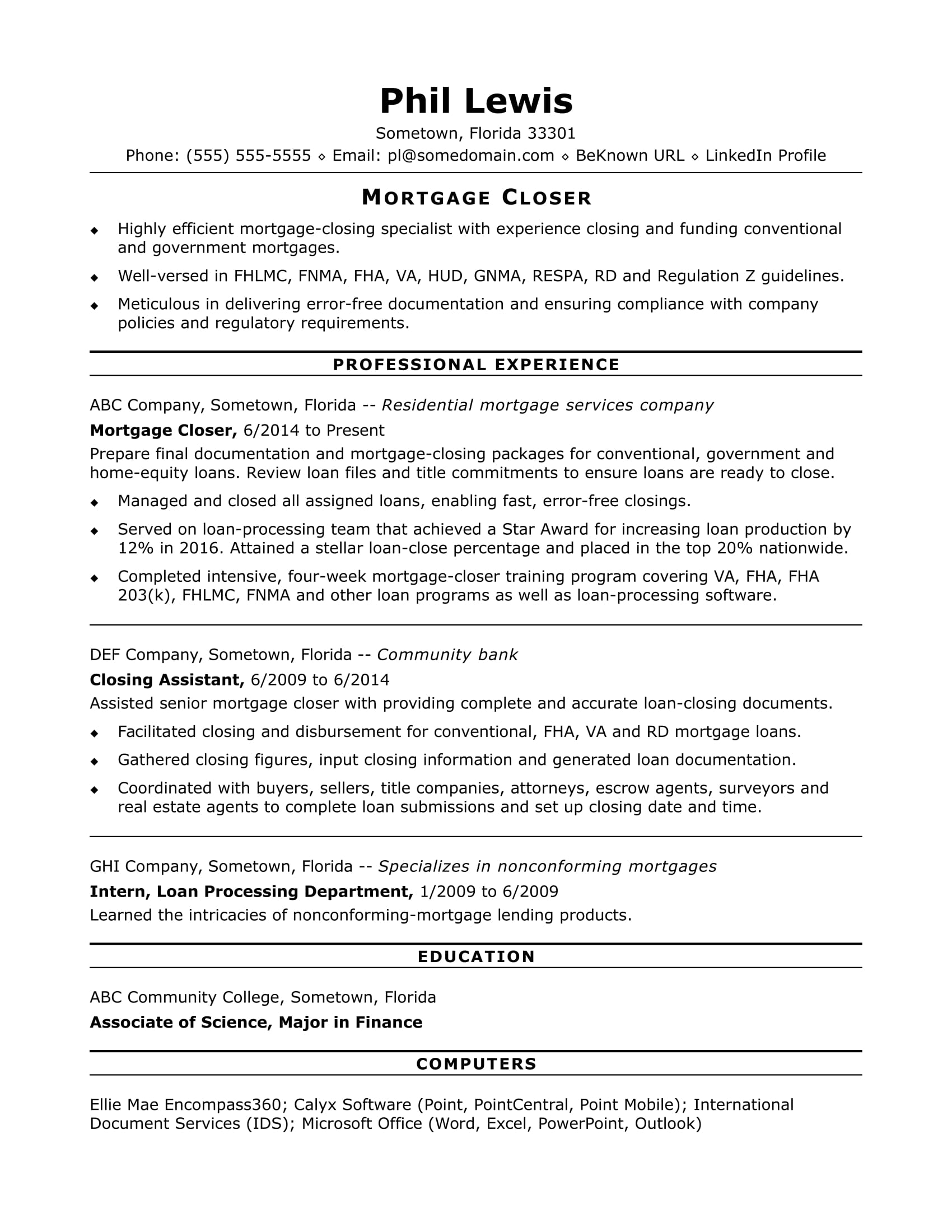

Mortgage Closer Resume Sample Monster Com

Homeownershipacademy On Twitter Buying First Home First Time Home Buyers Home Buying Process

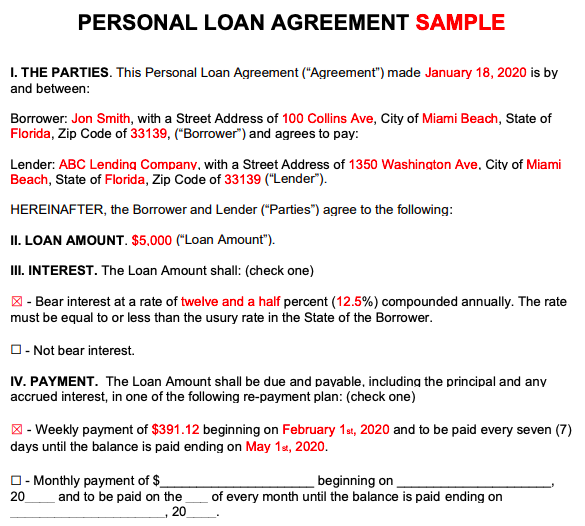

Personal Loan Agreements How To Create This Borrowing Contract

4 Financial Advantages Of Owning A Home Middleburg Real Estate Atoka Properties Financial Budgeting Money Budgeting

Debt To Income Dti Ratio What S Good And How To Calculate It

8245 Pawtucket Court Mortgage Calculator Mortgage Open Floor Concept

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fdic Applying For Your First Mortgage Loan

Infographic What S In Your Credit Score Devore Design Real Estate Photography Credit Score Infographic Mortgage Infographic Credit Score

Avoiding Gain At The S Shareholder Level When A Loan Is Repaid

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Avoiding Gain At The S Shareholder Level When A Loan Is Repaid

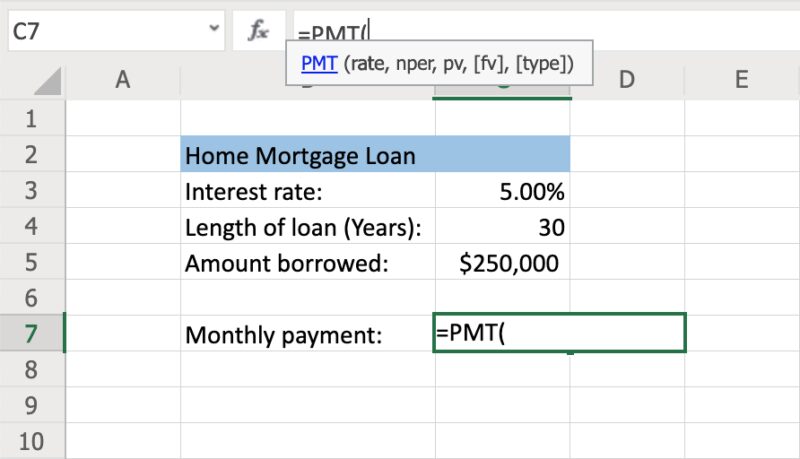

How To Calculate Monthly Loan Payments In Excel Investinganswers

Refinance With Fha Loan Program Loan Saver Direct Fha Loans Fha Savers